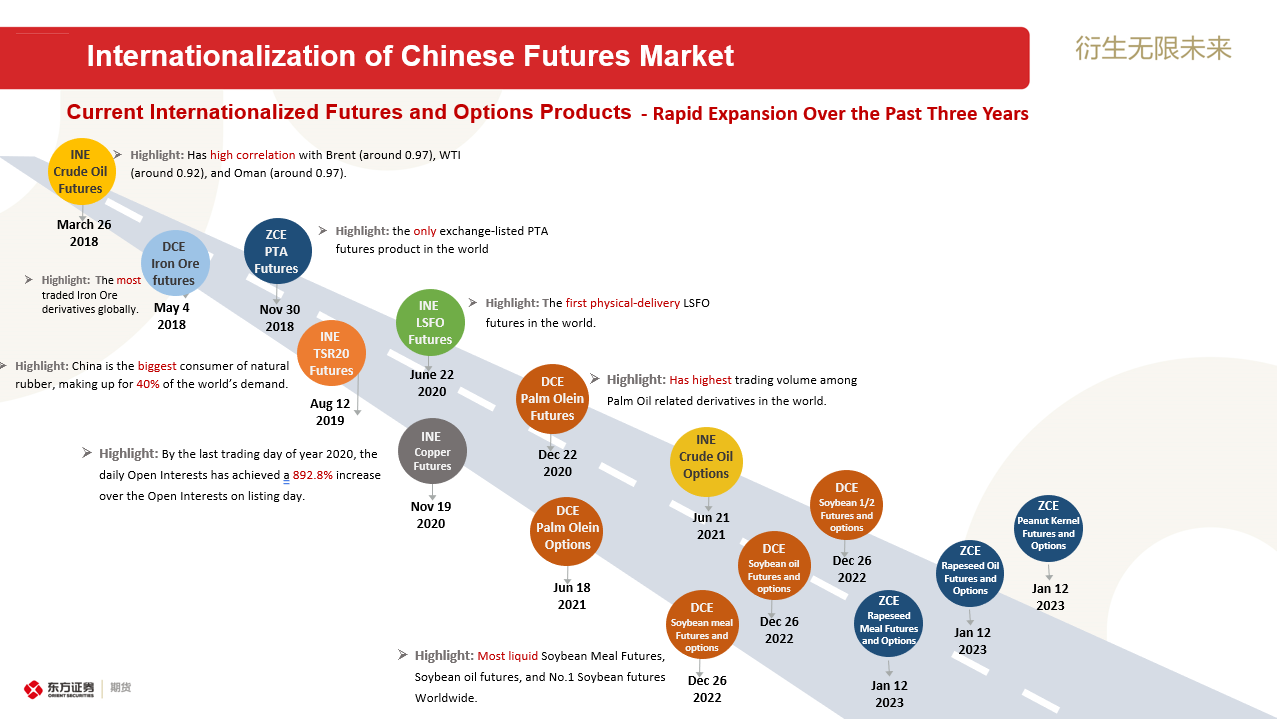

Figure 1:Internationalised Products from China’s Futures Market

As an overseas intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), Orient Futures Singapore offers global traders internationalised products from the Chinese exchanges.

The firm’s role as an intermediary is to facilitate communication and transactions between international investors and China’s financial markets. Some of the services that the firm offers include facilitating investment, assisting with settlement, and clearing, providing research and analysis from Shanghai Orient Futures, and acting as a bridge between different cultures.

All in all, the firm’s role is paramount to bridge the cultural and linguistic gaps between international investors and China’s financial markets, which enables smoother communication and transactions.

Newly Launched Products from DCE and ZCE

From China, outbound trade with the international audience has accompanied the country’s opening of borders and highly anticipated products.

At the end of 2022, DCE launched Soybean 1, Soybean 2, Soybean Meal, and Soybean Oil futures/options as internationalised products.

This is followed by Rapeseed Oil, Rapeseed Meal, and Peanut Kernel Futures, which were launched on January 12, 2023.

FIA’s article titled “China Further Expands International Access to its Commodity Markets” shows that while China’s commodity is relatively young compared to international markets, it serves as a crucial place for price discovery. In addition, agricultural futures are regarded as one of the most active contracts. Regardless of whether investors are trading through the QFI scheme or the RQFII, the relaxed procedures, ease of eligibility and implementation of the Futures and Derivatives law are likely to attract many.

As a guest speaker on the Panel on the derivatives landscape in China at FIA Asia 2022, Marcus Goi, managing director and chief executive of Orient Futures Singapore elaborated that Futures and Derivatives Law (FDL) delivers a strong legal foundation and provides protection for investors going into China.

Apart from this article, the key points of the conversations are also written in the “FIA Asia Spotlight: The Derivatives Landscape in China” article which can be accessed here.

.png)

CSRC Updates on Offshore Listing Regulations

On February 2023, China Securities Regulatory Commission (CSRC) has released a total of 35 detailed measures, which aim to optimize the current regulatory systems and requirements. From the organization, it is stated that the measures intend to refine the regulatory system by subjecting both direct and indirect overseas offering and listing activities to the filing-based administration, and clearly defining the circumstances where provisions for direct and indirect overseas offering or listings apply. Subsequently, the regulations aim to provide clarity, strengthen regulatory synergy, defile legal liabilities, and strengthen institutional inclusiveness.

2023 Bond Regulatory Work Conference (2023年债券监管工作会议)

Among the events the Bond Regulatory Work Conference highlighted the importance of a stable and healthy development of the market. Some of the key points include:

1) Building a modern bond market with a deepened role and Chinese based characteristics,

2) Reducing the risks from bond defaults,

3) Deepening and promoting the high-quality development of the REITs market,

4) Ensuring party management responsibilities.

Trading Other Products

Simultaneous to the updated policies and targets of the CSRC, traders can also look forward to other products from some of the largest and most comprehensive exchange such as CME, SGX, HKEX. Some of the flagship and featured products from each of the exchange have been covered are as follows:

CME:

5 Things To Know About Corn Futures

5 Things To Know About Aluminum Futures

E-Mini NASDAQ Futures and Micro E-Mini NASDAQ 100 Futures

Riding The Wave: Rough Rice Futures Amidst Global Food Supply Chain Disruption

SGX:

5 Things To Know About Singapore Exchange

What Are Cobalt Metal and Cobalt Hydroxide Futures

What Are Lithium Carbonate and Lithium Hydroxide Futures

SGX Launch of Mysteel Shanghai Rebar Futures

About Southeast Asian Indices

HKEX:

Hang-Seng China Enterprises Index Futures

JPY/CNH Futures

MSCI China A50 Connect (USD) Index Futures

These are some of the popular products that are traded by foreign investors on popular futures exchanges.

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG).

We provide premium customer service at an affordable cost to all our clients. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.